-crop-u2555.jpg?crc=3784020176)

Melbourne's most accessible law firm with a talented team of professionals

Finding the best lawyers is only half the job, you need to find the ones that suit your business

<

>

Important Change in Succession and Estate planning matters

New TFM Law now passed

The Justice Legislation Amendment (Succession and Surrogacy) Bill 2014 received Royal assent on 21 October 2014.

The Act makes changes to Part IV of the Administration and Probate Act 1958, in particular to the categories of people eligible to make claims for provision from a deceased estate and the considerations the Court must have regard to when determining applications.

The changes to Part IV applications are due to commence on 1 January 2015 if not proclaimed earlier, and will only apply in respect of the estate of any person who dies on or after the commencement date. Accordingly, current applications and estates will not be affected by the changes.

The changes to Part IV of the Administration and Probate Act will:

1. Restrict the type of person who is eligible to make a claim for family provision from a deceased estate to:

a) the spouse or domestic partner at the time of the deceased's death;

b) a child of the deceased, including a stepchild or adopted child who, at the time of the deceased's death, was under the age of 18 years; or a full-time student aged between 18 years and 25 years; or under a disability;

c) a former spouse or former domestic partner, who at the time of the deceased's death would have been able to take proceedings under the Family Law Act 1975 and is prevented from doing so because of the death of the deceased;

d) a child or stepchild of the deceased other than one under 18 years old, a full time student between 18 and 25 years old or under a disability;

e) a registered caring partner;

f) a grandchild;

g) a spouse or domestic partner of a child of the deceased if the child of the deceased dies within one year of the deceased's death;

h) a member of the household of which the deceased was also a member.

2. Define disability consistently with the definition in the Commonwealth National Disability Insurance Scheme Act 2013

3. Do not define dependent, but provides that when determining dependency the Court must disregard any means-tested government benefits the eligible person receives or is eligible to receive.

4. Change the terminology: the deceased must have had a moral duty to provide for the applicant, rather than the current responsibility.

5. Require that for applicants falling within categories listed in (e) to (h) in paragraph 1, the Court must be satisfied that the person was wholly or partly dependent on the deceased for their proper maintenance and support.

**note the Bill was amended so that the Act no longer refers to dependency at the time of the deceased’s death; however, when determining the amount of provision the Act still refers to the dependency at the time of the deceased’s death.

6. Specify when determining the amount of provision, the Court must have regard to:

a) the degree to which, at the time of death, the deceased had a moral duty to provide;

b) the degree to which the distribution of the estate fails to make adequate provision;

c) the degree to which the eligible person is not capable, by reasonable means, of providing adequately for the eligible person's proper maintenance and support (only in relation to adult children under category (d) above);

d) the degree to which the eligible person was wholly or partly dependent on the deceased at the time of the deceased’s death (only for applicants falling within (e) to (h) above).

7. Limit the amount of provision by reference to the amount necessary for the applicant’s proper maintenance and support; and requires (for applicants falling within (e) to (h) above) the amount to be proportionate to the degree of dependency at the time of the deceased’s death.

8. Change the nature of the Court’s considerations in making a family provision order:

a) the Court must to have regard to the deceased’s will, any evidence of the reasons for making the dispositions in the will and any other evidence of the deceased’s intentions in relation to providing for the applicant;

b) the Court may, rather than must, have regard to the criteria currently outlined in s91(4)(e)-(p);

c) adds an additional criteria: the Court may have regard to the effect an order would have on the amounts received by other eligible persons.

Asset protection and business structuring

With the introduction of the Personal Property Securities Act (‘PPSA’) in January 2012, it is important that accountants, lawyers and business advisors are aware of the impact of this Legislation upon business transactions and advice provided in the area of asset protection and business structuring.

The Law

At this point in time, it is important to recap the various sections of Legislation that Security Interest holders under the PPSA should be aware of:

Vesting of Security Holders Interest

Section 267(2) and 267A of the PPSA deals with the vesting of security interests in the grantor upon winding up or bankruptcy. A security interest may vest in the grantor where:

The security interest is not perfected

The registration of a security interest to enable perfection is not completed within the relevant time period.

It should be noted that loss of ownership is effectively the outcome in many cases.

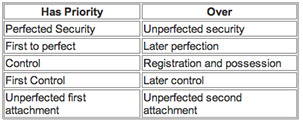

Default priority Rules

Security holders ought to be aware of Section 55 of the PPSA which provides default priority rules as set out in the table below:

Security holders should also be aware of Section 320 of the PPSA which provides a guide to priority rules for transitioning security interests. The Legislation provided for a transitionary period of 2 years until 29 January 2014 to allow for Security Holders to register their security interest on the Personal Property Securities Register (PPSR). In most circumstances, prior to the introduction to the PPSA, those security interest claims were not required to be registered. Examples of such interests include retention of title claims, leases and consignment stock arrangements.

Created by redmustard

Level 9, 179 Queen Street

Melbourne 3000

Victoria Australia

T: +61 3 8631 5555

F: +61 3 8631 5599

E: office@mga-lawyers.com